capital gains tax increase 2022

Rocky Mengle Senior Tax Editor. Also known as homeowner exemption it allows you to save capital gains tax on home sales when you sell a.

7 Stocks That Could Benefit From A Capital Gains Tax Hike In 2022 Marketbeat

However it was struck down in March 2022.

. 1 2022 and the first payments are due on or before April 18 2023. 539901 up from 523601 in 2021 Head of Household. The tax takes effect on Jan.

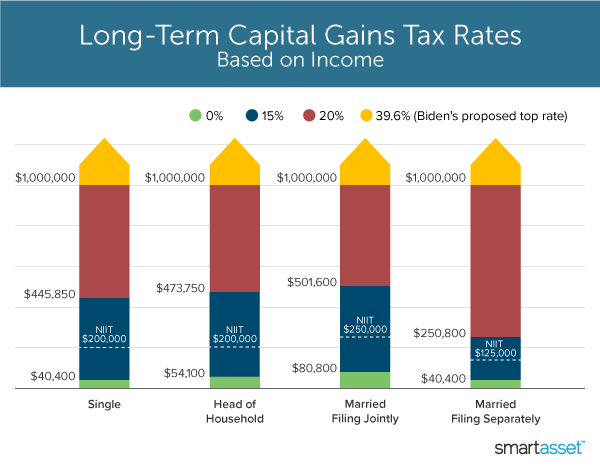

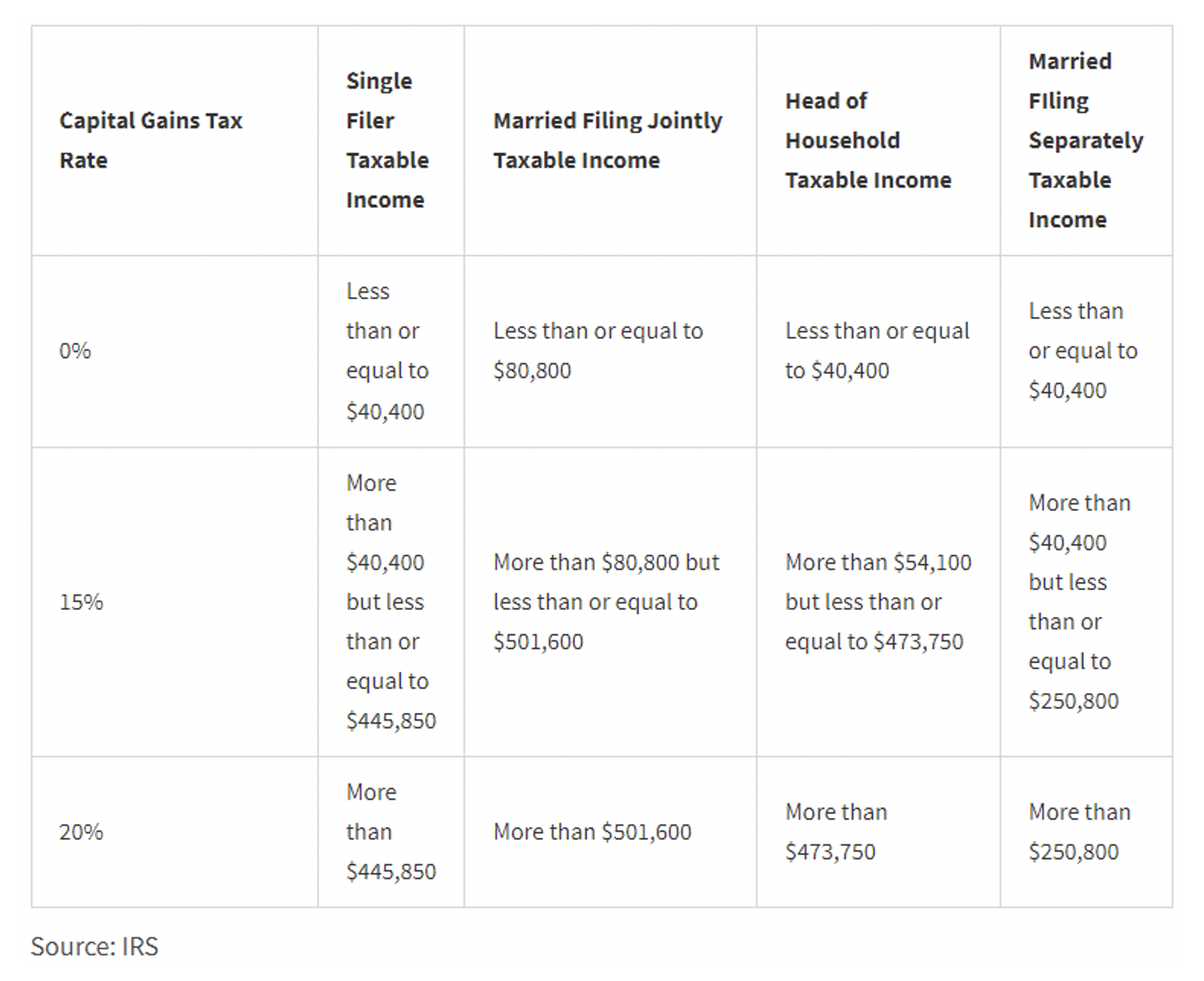

Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. The Chancellor is weighing an increase in the rate of Capital Gains Tax CGT as well as taxes on dividends in advance of the Autumn Statement. Here are the minimum income levels for the top tax brackets for each filing status in 2022.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. With this new plan that rate will increase to a whopping 396--nearly. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or.

This included the increase of GT rates so they were more similar to income tax which was a big problem for anyone looking to sell. 500000 of capital gains on real estate if youre married and filing jointly. It means that when capital gains taxes most assuredly will increase from the current maximum 20 to 396 in 2022 under the Biden administrations plan you will be.

Weve got all the 2021 and 2022 capital gains. Extending expanded child tax credit through 2025. The IRS typically allows you to exclude up to.

Capital Gains Tax Rates 2021 To 2022. The Capital Gains Tax rates and allowances for 2022 are. A Washington capital gains tax credit for the amount of any legally imposed income or excise.

2023 capital gains tax rates. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from. When you include the 38 net investment.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. The bill aims to increase the top capital gains rate AND prevent a rush to the exits while the rates are still lower. Hunts capital punishment for businesses and homeowners.

2022 capital gains tax calculator. At this event it is. Capital gains tax which is levied on profits from the sale of assets is expected to raise 15 billion in the current tax year according to the Office for Budget Responsibility.

CGT is expected to raise 15bn in 2022-23 or 15pc of all receipts. President Biden recently announced his plan to double the long-term capital gains tax rate for those at the top from 20 to 40. 250000 of capital gains on real estate if youre single.

The very first trick you can utilize is section 121 exclusion. The new tax rates would therefore apply retroactively from. Hunt is also considering an increase in.

As it stands right now those in the high-income tax rate currently see only a 20 capital gains tax on certain assets. Capital gains taxes on assets held for a. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Capital gains tax could increase but there are ways to save Image. Mr Osborne the chancellor then decided to increase capital gains tax bringing in a new rate of 28pc for. The top federal rate would be 25 on long-term capital gains which is an increase from the existing 20.

Friday 04 November 2022 701 am Rise in capital gains tax on the cards as Chancellor Hunt scrambles to raise 50bn By. The same as for 2021 to 2022 - 12300. Chancellor mulling increase in gains and dividend taxes under plan to make broadest shoulders pay most to fill.

For single tax filers you can benefit.

Want To Sell Your Business To Beat 2022 Tax Increases Consider Charitable Bunching

Tax Policy And The Economy Vol 36

Capital Gains Trade Nears Potential Deadline As Legislation Looms

A Popular Way To Avoid Capital Gains Taxes

What You Need To Know About Capital Gains Tax

Capital Gains Let S Rumble Jared Bernstein On The Economy

Impact On Jobs Tax Revenue And Economic Growth Of Proposed Tax Increase On Carried Interest Center For Capital Markets Competitiveness

Biden S Long Term Capital Gains Tax Increase Will Spur Selling Tek2day

What S In Biden S Capital Gains Tax Plan Smartasset

Proposed Capital Gains Tax Increase Kenya Real Estate

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

11 Mmajor Tax Changes For 2022 Pearson Co Cpas

Income Tax Increases In The President S American Families Plan Itep

Short Term Capital Gains Tax Rates For 2022 Smartasset

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

State Taxes On Capital Gains Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)